irrevocable trust capital gains tax rate 2020

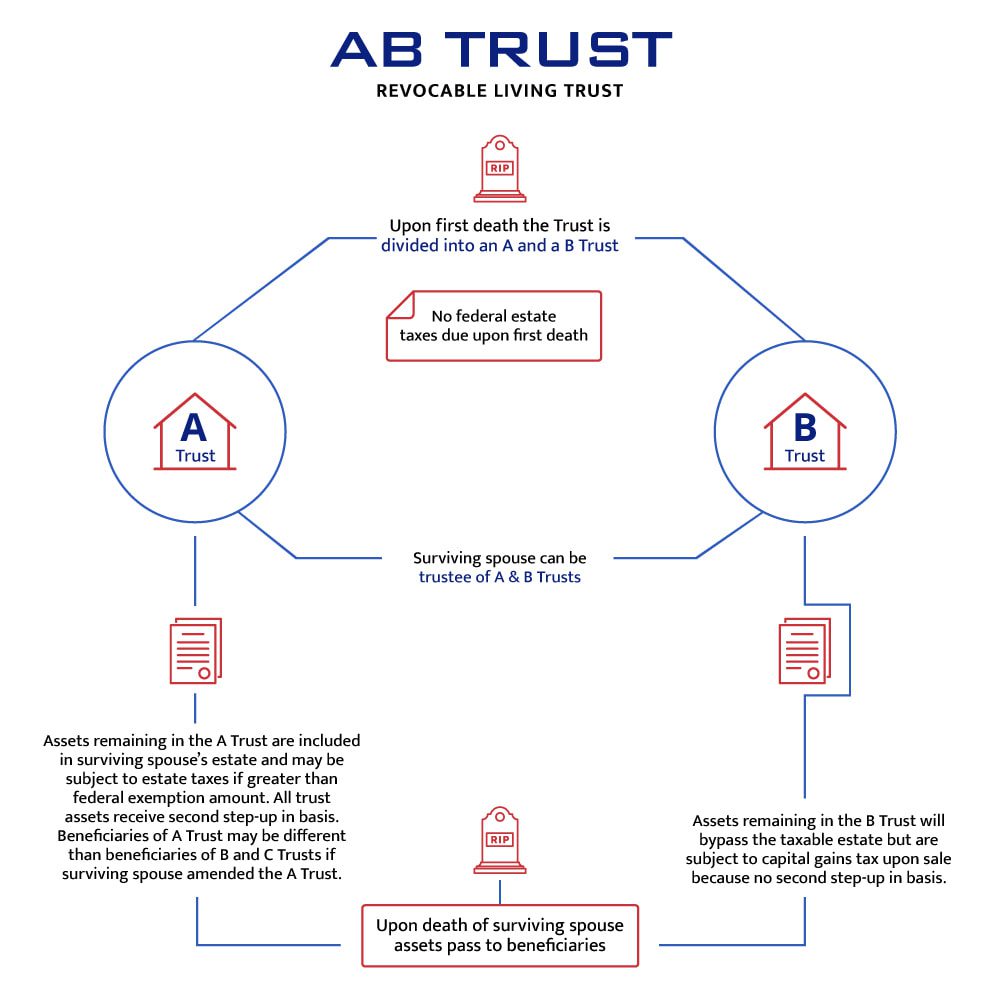

To A B Or Not To A B That Is The Question Botti Morison

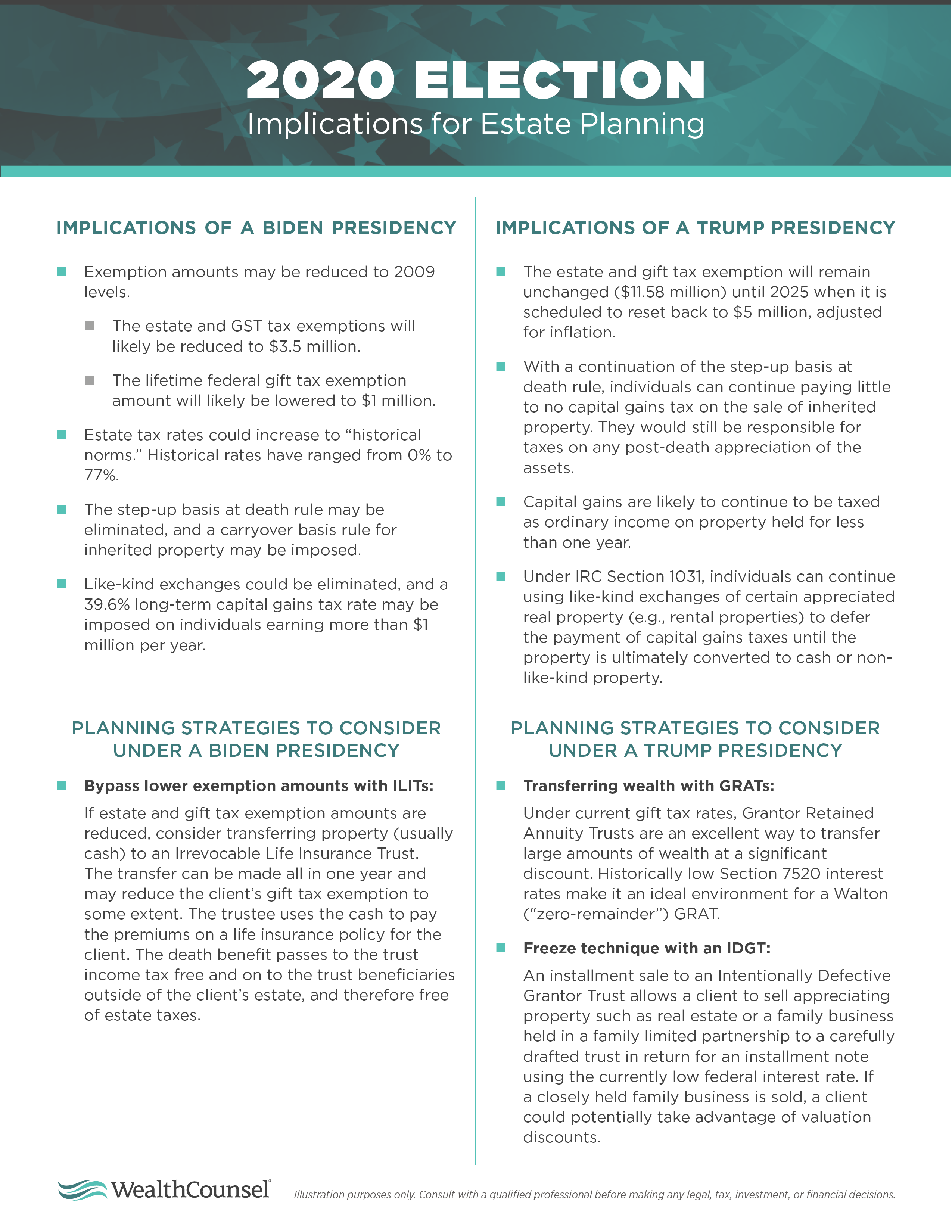

Election Special Bulletin 1 Tax Plan Proposal

How To Avoid Estate Taxes With A Trust

Interest Rates At Historic Lows Wealth Transfer Opportunities At Historic Highs Hundman Wealth Planning

Distributable Net Income Tax Rules For Bypass Trusts

To A B Or Not To A B That Is The Question Botti Morison

Recent Developments In Estate Planning Part 1

How To Avoid Estate Taxes With A Trust

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Biden Tax Plan And 2020 Year End Planning Opportunities

Do Irrevocable Trusts Pay Capital Gains Taxes Estate Planning In New Hampshire Massachusetts

Living Trust Plus Frequently Asked Questions Farr Law Firm

Generation Skipping Trust Gst What It Is And How It Works

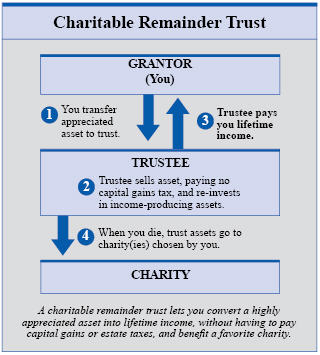

Estate Planning 101 Series Lesson 1 Charitable Remainder Trusts Eckert Byrne Llc

Understanding Charitable Remainder Trusts Buckley Law

4 Election Year Tax Strategies You And Your Clients Need To Consider

Capital Gains Taxes And Irrevocable Trusts Burner Law

Tax Strategies Using Nua For Modestly Appreciated Stock

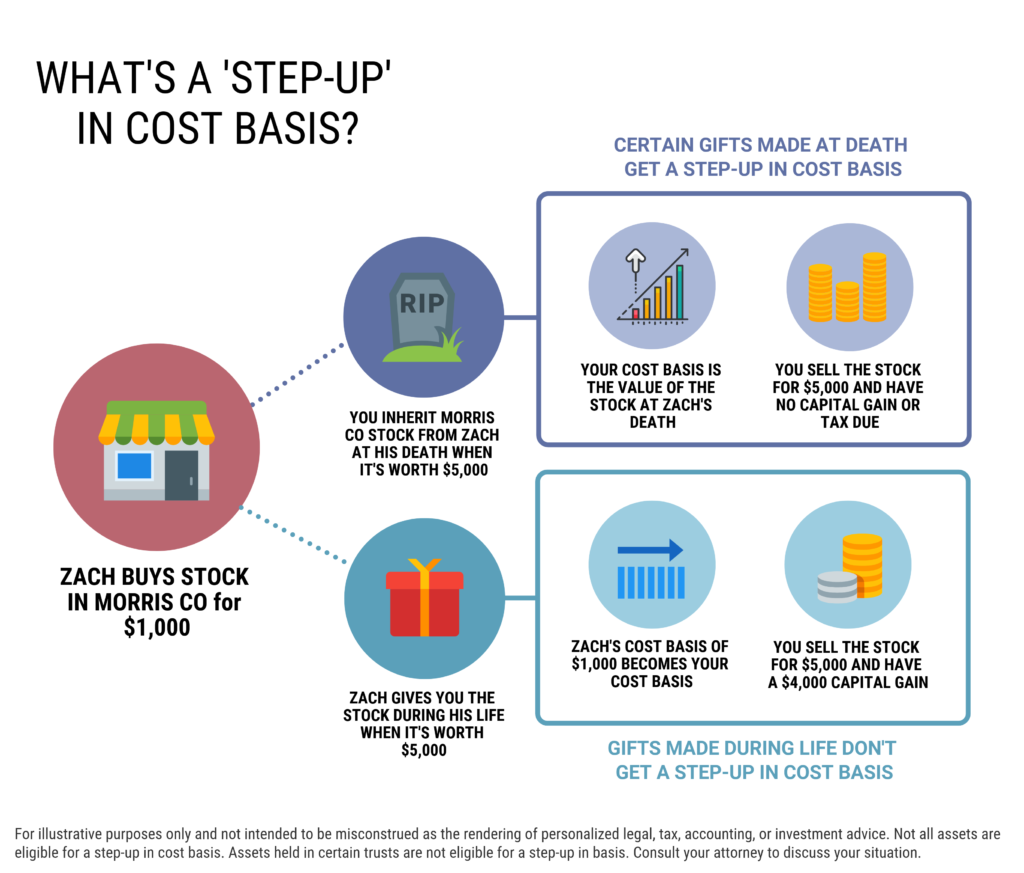

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal